Know everything about Anthem Biosciences IPO GMP in 2025—GMP trend, share price listing, and post-IPO outlook for investors.

Introduction

Anthem Biosciences IPO GMP.The year 2025 witnessed one of the most anticipated IPOs in the Indian biotech space — Anthem Biosciences Ltd. With its strong presence in the Contract Research, Development, and Manufacturing Organization (CRDMO) sector, Anthem Biosciences generated massive interest among investors. The buzz around the IPO was evident from its high Grey Market Premium (GMP), robust subscription numbers, and impressive listing performance.

This article explores the IPO’s GMP trend, listing performance, financial strength, and what investors can expect going forward.

Anthem Biosciences, a Bengaluru-based biotech giant, created massive investor buzz in 2025 with its highly anticipated IPO. Known for its cutting-edge CRDMO services, the company’s public debut caught the attention of retail and institutional investors alike.

With strong grey market premiums (GMP), record-breaking subscription, and a powerful 27% listing gain, the IPO has set new benchmarks in India’s pharma and biotech sector.

What Is GMP and Why Does It Matter?

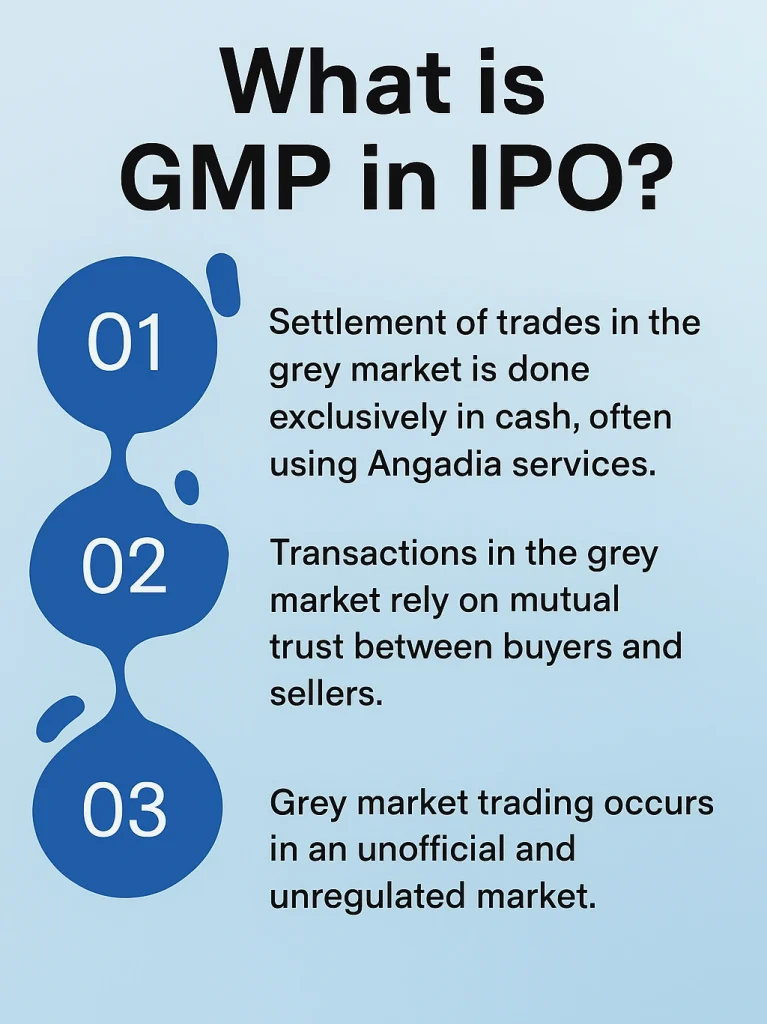

Grey Market Premium (GMP) is the unofficial premium at which IPO shares are traded before official listing. It is a direct indicator of public sentiment and expected performance.Anthem Biosciences IPO GMP

In Anthem’s case:

- GMP rose to ₹165–177 just before listing.

- This indicated an estimated 30% listing gain on the issue price of ₹570.

- Investors were expecting the shares to list around ₹735–₹750.

Though GMP is not always accurate, it acts as a sentiment thermometer for IPO performance.

Anthem Biosciences IPO GMP Timeline

- IPO Opening Date: July 14, 2025

- IPO Closing Date: July 16, 2025

- Allotment Finalized: July 17, 2025

- Listing Date: July 21, 2025

- Issue Price Band: ₹540 – ₹570 per share

- Lot Size: 26 shares per lot

The IPO consisted entirely of an Offer For Sale (OFS), meaning no fresh shares were issued.Anthem Biosciences IPO GMP

Subscription Status: Who Invested How Much?

The IPO saw an overwhelming response from all investor segments.

| Category | Subscription (x) |

|---|---|

| Qualified Institutions (QIB) | 192.8× |

| Non-Institutional Investors (NII) | 44.7× |

| Retail Individual Investors (RII) | 5.6× |

| Overall | 67.4× |

Such a massive subscription reflects investor confidence in Anthem’s business model and financial strength.Anthem Biosciences IPO GMP.

Listing Day Performance: A Strong Debut

Anthem Biosciences made a stellar entry on the stock exchanges:

| Exchange | Listing Price | Gain Over Issue Price |

|---|---|---|

| NSE | ₹723.05 | +26.85% |

| BSE | ₹723.10 | +26.86% |

Although the actual listing was slightly below GMP expectations, a 27% gain still qualifies as a strong debut.

GMP vs Actual Listing: A Small Gap

While the GMP indicated a potential listing around ₹740, the stock opened at ₹723. This slight dip can be attributed to broader market volatility and investor profit booking.

Yet, the 27% gain over the issue price validates the IPO’s strength.

Financial Highlights Before IPO

Anthem Biosciences showcased solid financials before going public:

- Revenue (FY25): ₹1,844 crore

- EBITDA Margin: 37%

- Return on Capital Employed (ROCE): 27%

- No Debt Pressure: Strong balance sheet

These fundamentals further justified the rich valuation and high GMP.