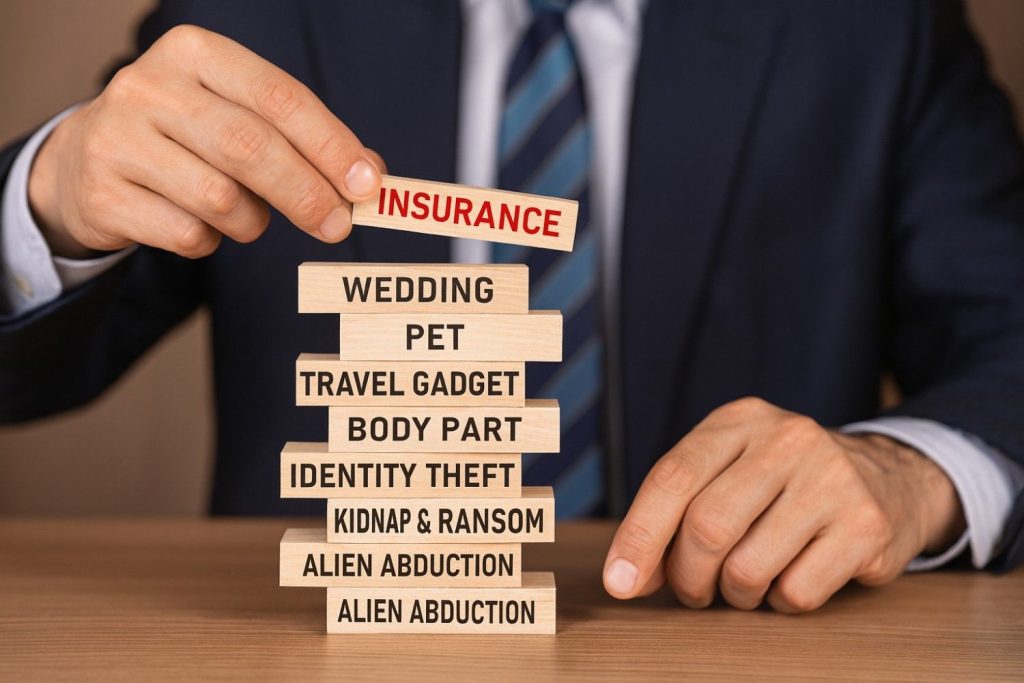

Discover 7 unknown types of insurance you didn’t know existed — from wedding and pet coverage to identity theft. Protect more than you think.

Most of us are familiar with life, health, or car insurance. But the world of insurance is surprisingly diverse — filled with policies that protect everything from pets to parties.

In this article, we’ll explore 7 unknown types of insurance that many people have never heard of — but might actually need more than they realize.

What Are Unknown Types of Insurance?

Most of us know about common insurance plans like health, life, or car insurance. But there are many unknown types of insurance that protect you from unusual and unexpected risks. These include coverage for weddings, pets, expensive gadgets, and even identity theft.

Such unique policies are designed to provide peace of mind in areas where traditional insurance falls short. Exploring these options can help you stay prepared for life’s surprising challenges.

Why They Exist

Unknown types of insurance exist to cover gaps that traditional policies don’t address. As lifestyles, risks, and industries evolve, so do the needs for more specialized protection. For example, pet owners now seek medical coverage for animals, and travelers need gadget insurance for expensive devices.

Events like weddings or identity theft come with financial risks that were once ignored. These policies are designed to offer peace of mind in today’s unpredictable world, where one-size-fits-all coverage is no longer enough.

Unknown Types of Insurance You Might Actually Need

Insurance isn’t just for cars or hospitals. There are several unknown types of insurance that quietly protect against unexpected situations — like wedding cancellations, pet emergencies, or identity theft. These overlooked policies might be more useful than you think.

1. Wedding Insurance

This protects you from losses due to vendor cancellations, bad weather, or venue issues. Ideal for anyone planning a big event.

2. Pet Insurance

Veterinary costs can be shockingly high. Pet insurance helps you manage medical care for your dog, cat, or even exotic pets.

3. Travel Gadget Insurance

Covers your phones, laptops, and cameras from loss or damage during travel. A must-have for digital nomads and frequent flyers.

4. Body Part Insurance

Famous athletes and celebrities often insure specific body parts crucial to their careers — like legs, hands, or vocal cords.

5. Identity Theft Insurance

Covers expenses related to restoring your identity, including legal help, lost wages, and credit monitoring.

6. Kidnap & Ransom Insurance

Used by high-risk professionals and global travelers, this policy provides financial protection during kidnapping or extortion.

7. Alien Abduction Insurance

A novelty for sure — but yes, some people do get insured for alien encounters. It’s real, and often just for fun.

FAQs About Unknown Types of Insurance

What is the rarest type of insurance?

Alien abduction insurance is among the rarest, often used as a novelty or marketing gimmick.

Are unknown insurance types legit?

Yes. While some sound unusual, many are legitimate policies offered by specialty insurance providers.

Do I really need these types of insurance?

It depends on your lifestyle. If you’re planning a wedding, traveling with expensive gear, or working in risky environments — yes, you might.

Where can I buy these types of insurance?

Specialty insurance companies and brokers often provide these policies. Always verify licenses and terms before purchasing.

Final Thoughts: Why Unknown Types of Insurance Matter

Insurance isn’t just about cars and hospitals. These unknown types of insurance prove that protection can be as unique as the risks we face.

From your pet’s health to your wedding day — or even your online identity — modern insurance has you covered in unexpected ways.

So next time you think about coverage, don’t just go for the obvious. Explore the unknown.