Explore health insurance tax benefits 2025 under Section 80D. Maximize deductions, save up to ₹1 lakh, and learn the claiming process step-by-step.

Taking health insurance tax benefits 2025 not only secures your health but also offers smart tax savings. In India, Section 80D of the Income Tax Act lets you claim deductions up to ₹1 lakh per year, making it a powerful financial tool.

In this guide, you’ll get:

- How much you can save under 80D in 2025

- Deduction limits for self, family, and parents

- Step-by-step claim process

- Smart planning tips

- FAQs & latest updates

Let’s dive in!

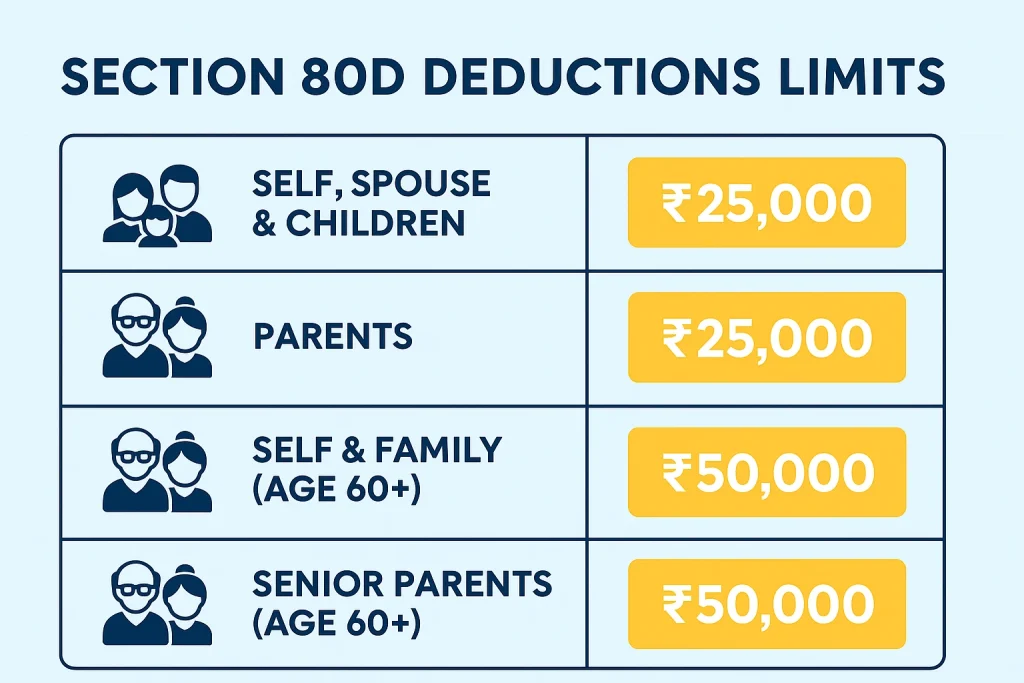

Understanding Section 80D Tax Deductions

Section 80D provides deductions on health insurance premiums (including preventive health check-ups) paid for yourself, your spouse, children, and parents. The maximum deduction you can claim reaches up to ₹1 lakh per year

Breakdown of Limits:

- Self, spouse & children (below 60): ₹25,000

- Parents (below 60): ₹25,000

- Self/family (60+): ₹50,000

- Senior parents (60+): ₹50,000

- Preventive health check-ups: ₹5,000 (included within above limits)

Total possible deduction:

- Self/family + senior parents = ₹50,000 + ₹50,000 = ₹1 lakh

- ₹5,000 included across categories

Extra Deduction for Senior Citizens

For older adults (60+), the health insurance deduction doubles:

- Self or senior parents qualify for ₹50,000

- If both you and parents are 60+, you can claim a total ₹1 lakh

Lives in HUF? You can also claim under 80D

How 80D Works – Sample Calculation

Prashant’s 2025 health insurance:

- ₹30,000 for family (self, spouse, children under 60)

- ₹47,000 for parents (parents are 62+)

- ₹15,000 preventive check-ups (₹10K for self+kids, ₹5K for parents)

He can claim:

- Self/family premium = ₹25,000

- Preventive check-up = ₹5,000

- Senior parents = ₹47,000

- Preventive parents = ₹3,000 (limit)

Total = ₹80,000 deduction

Claiming Preventive Health Check-Ups

The deduction covers general check-ups such as:

- Blood sugar, ECG, dental screening – up to ₹5,000 per year

Section 80D vs Section 80C

While 80D reduces tax through health premiums, Section 80C offers a ₹1.5 lakh deduction for:

- Life insurance premiums

- PPF, EPF, NSC, ELSS, ULIPs

You can combine both deductions for maximum tax saving.

Term Insurance & Riders – Double Benefits!

- Term insurance premiums eligible under Section 80C up to ₹1.5 lakh

- Critical illness or hospital-care riders also covered under 80D (up to ₹25,000)

- Maturity and death benefits are tax-free under Section 10(10D) unless premiums > ₹5 lakh

Max Tax Saving Strategy – Combine Smartly

| Deduction Source | Claimable Amount (₹) |

|---|---|

| Section 80C | 1,50,000 |

| Section 80D | 1,00,000 |

| Total Tax-saving | 2,50,000 |

Plus, if your taxable income < ₹12 lakh, you can claim Section 87A rebate.

How to Claim 80D – Step-by-Step

- Pay health insurance premiums via bank, UPI, cheque – no cash TaxTMI+5ICICI Prudential Life Insurance+5Policybazaar+5.

- Keep receipts and policy numbers for you and parents The Times of India.

- Fill Section 80D details in ITR form (premium eligibility fields).

- Attach details of insurer and policy number TaxBuddy.com+1The Times of India+1.

- File ITR – either through form or employer payroll.

- health insurance tax benefits 2025

Important Notes: Health Insurance Tax Benefits 2025

- Only non-cash payments are deductible

- ICICI Prudential Life InsuranceTaxBuddy.com.

- Multiple children, grandparents etc. can claim separately.

- NRIs can also claim 80D if paying Indian insurance ↳ parent included

- Check “new regime vs old regime” – if you skip deductions, new regime might save more Policybazaar+14iNRI+14Moneycontrol+14.

2025 Updates & Filing Tips

health insurance tax benefits 2025

- ITR requires insurer details & policy numbers to avoid fake claims

- The Times of India.

- Many taxpayers opt for the simpler new tax regime – without deductions like 80D.

- If deductions > tax saved, stick with old regime; otherwise, switch

- HDFC Life+15Income Tax Department+15iNRI+15.

Who Should Prioritize 80D in 2025?

- Young professionals (below 60)

- Parents of senior adults

- Families with medical check-ups

- Policyholders with critical illness cover

- NRIs investing in Indian insurance

Top Tips to Maximize 80D Benefits

- Buy separate policies for self and senior parents

- Add preventive check-up riders

- Pay premiums via digital channels

- Keep receipts & policy records

- Review new vs old tax regime annually

Frequently Asked Questions (FAQ)

Q1. Can parents claiming 80D be financially independent?

Yes — independence or joint account doesn’t matter; you can claim

Q2. Are cash health premiums deductible?

No — only digital or cheque payments count

Q3. Can HUFs claim 80D?

Yes — provided the HUF pays the premium

Q4. Is maturity benefit taxable?

No — under Section 10(10D), unless premium > ₹5 lakh

Q5. Should I choose old or new tax regime?

If your total deductions (80C+80D) exceed tax saved under new slab, stick with old regime; otherwise, switch

Know more related:

Top 10 Cheap Health Insurance Plans for 2025

Final Thoughts

Health insurance tax benefits 2025 are more than just savings—they are a smart way to protect your family and reduce tax legally. With Section 80D offering up to ₹1 lakh deduction, combined with 80C, you can maximize savings. File correctly, keep docs, and stay ahead financially.

📈 Start planning your policies now, and make 2025 your most financially savvy year yet!