- Post Office Counter (cash/cheque)

- Online Portal (India Post PLI)

- Auto-debit (salary deduction for employees)

- India Post Mobile App

Note: Premiums start as low as ₹250/month (varies by sum assured).

How to Apply for Post Office Life Insurance (2025)

Offline Method

- Visit your nearest post office.

- Fill the PLI/RPLI application form.

- Submit documents + medical exam (if required).

- Receive policy bond within 15–30 days.

Online Method

- Go to PLI Customer Portal

- Register/login with mobile/email.

- Upload documents + pay premium online.

- Download policy details instantly.

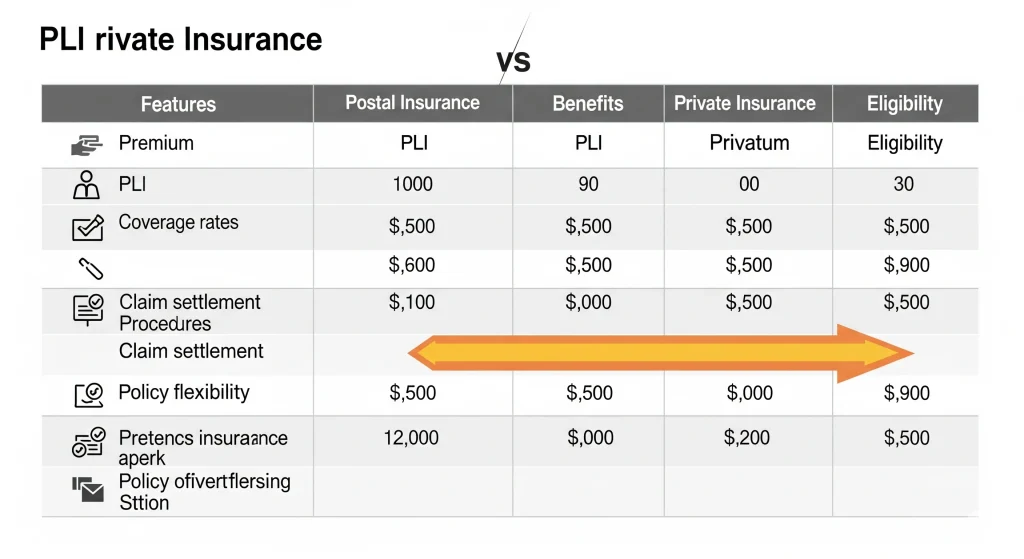

PLI vs. Private Life Insurance

| Factor | Post Office Insurance | Private Insurers |

|---|---|---|

| Trust | Govt-backed, 100% secure | Depends on company stability |

| Cost | Cheaper premiums | Higher premiums |

| Customization | Limited plan options | More add-ons (riders) |

| Claims | Faster settlement | Varies by insurer |

FAQs

Q1. Is Post Office Life Insurance safe?

Yes! It’s government-guaranteed, making it safer than private policies.

Q2. Can private employees buy PLI?

Only RPLI is open to all; PLI is for govt/defense employees.

Q3. How to check PLI policy status?

Use the PLI portal or visit your post office.

Q4. Are there maturity benefits?

Yes! Endowment plans (like Santosh) pay lump sums at maturity.

Final Verdict

Post Office Life Insurance is a budget-friendly, trustworthy alternative to private policies. With low premiums, bonuses, and tax perks, it’s ideal for long-term savings + family protection.

Ready to apply? Visit India Post PLI today!