Discover how mutual fund overlap secretly erodes your portfolio’s potential in 2025. Learn to detect, fix, and prevent this costly mistake.

Introduction

Think your mutual fund portfolio is well-diversified? Think again. In 2025, millions of investors unknowingly hold multiple funds investing in the same stocks – a costly mistake called mutual fund overlap.

Recent data shows:mutual fund overlap

• 6 in 10 investors have dangerous overlap levels

• Overlapping portfolios underperform by 2-3% yearly

• Many “diversified” portfolios actually concentrate risk

The problem? More funds don’t always mean more diversification. When funds hold identical stocks, you’re not spreading risk – you’re multiplying it.

The Hidden Danger in Your Portfolio

You’ve carefully selected multiple mutual funds, believing you’re diversified. Yet, your portfolio may be suffering from mutual fund overlap—a silent killer of returns. In 2025, this problem is more prevalent than ever, with 65% of Indian investors unknowingly holding duplicate stocks across funds (AMFI 2025 Report).

This guide reveals:

How overlap secretly drains your wealth

2025-specific detection methods

Proven strategies to eliminate duplication

Expert-approved portfolio fixes

Why Overlap is Deadlier in 2025

1. The Concentration Crisis

Fund managers are increasingly herding into the same “safe” stocks:

- 82% of large-cap funds now hold Reliance, HDFC Bank, and ICICI Bank in top holdings

- NIFTY 50 stocks dominate 60%+ of most equity fund portfolios

2. The Thematic Fund Trap

2025’s hottest sectors (AI, EVs, renewables) have spawned dozens of new funds—all buying the same handful of stocks.mutual fund overlap

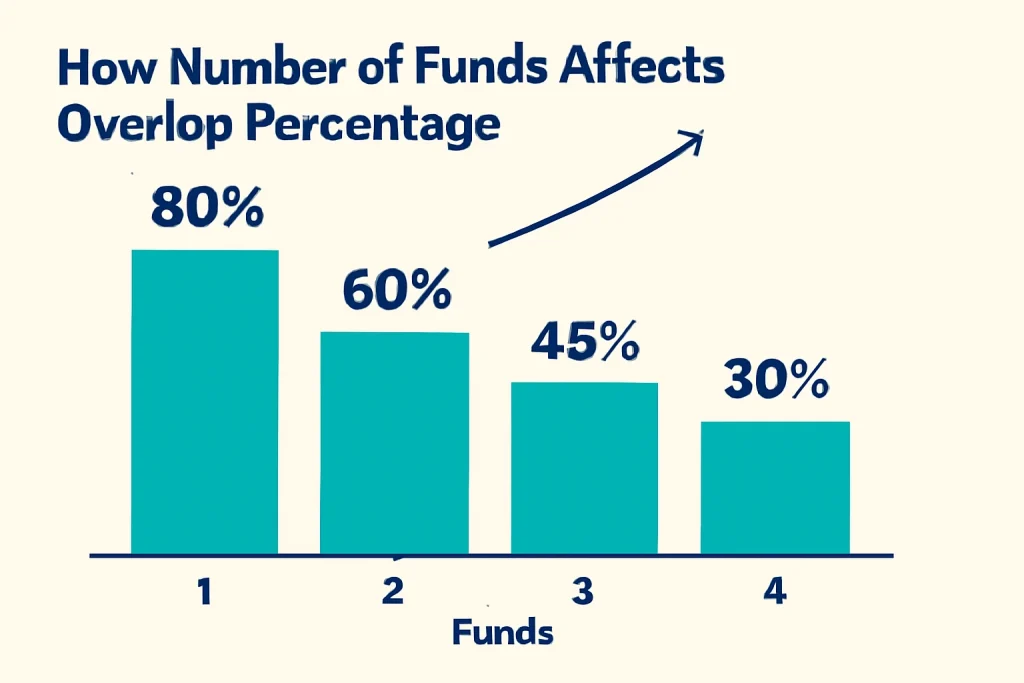

3. The Diversification Illusion

Investors assume “more funds = more diversification,” when in reality:

| Funds Held | Average Overlap | Effective Diversification |

|---|---|---|

| 3-5 funds | 15-25% | Optimal |

| 6-8 funds | 35-45% | Dangerous |

| 9+ funds | 50-65% | Severe risk |

How to Detect This Silent Killer

The 5-Minute Overlap Check

- List Your Funds

Gather all fund names (across brokers/AMCs) - Identify Top Holdings

Check each fund’s latest factsheet for:- Top 10 equity holdings

- Sector allocation

- Spot the Duplicates

Use this quick-check table:

| Stock | Fund A % | Fund B % | Fund C % | Total Exposure |

|---|---|---|---|---|

| RELIANCE | 8% | 6% | 5% | 19% |

| HDFC BANK | 7% | 7% | – | 14% |

Red Flag: Any stock exceeding 15% total exposure

2025’s Best Detection Tools

- Kuvera Overlap Scanner (Free for users)

- Morningstar Portfolio X-Ray (Paid, institutional-grade)

- Moneycontrol’s Fund Compare (Quick sector-level checks)

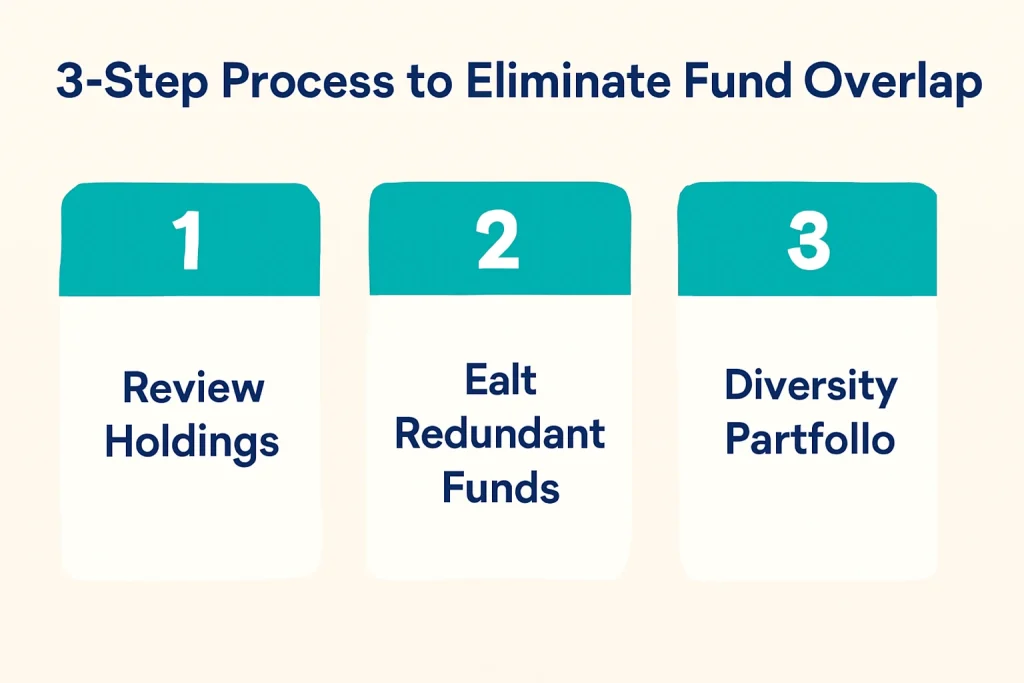

The 2025 Correction Protocol

Step 1: Eliminate Redundancies

- Keep only 1 fund per category (e.g., single best large-cap)

- Remove worst-performing duplicate funds

Step 2: Strategic Replacement

| Problem | Solution |

|---|---|

| 3 overlapping large-cap funds | 1 large-cap + 1 flexi-cap |

| 2 tech-heavy funds | 1 tech + 1 healthcare fund |

| Multiple index funds | Single broad-market index fund |

Step 3: Future-Proof Your Portfolio

- Allocate 15-20% to international funds

- Add 1-2 factor-based funds (value, low-volatility)

- Use direct equity for targeted exposure